The best operators are training algorithms, building trust, and tightening funnels now.

👋 Welcome back to Signals

Peak season’s knocking and this week’s issue is your Q4 tune-up. The theme? Smarter, not louder.

We’re breaking down what the latest data says about how shoppers (and operators) are behaving heading into BFCM. From Emarsys’ retention-first report to Meta’s six biggest Q4 mistakes, one thing’s clear: the brands that win this year won’t wait for Black Friday…they’re already warming audiences and building trust now.

Plus: the YouGov stats every marketer should see before setting ad budgets, and the operators leading the way: Graza with cult-brand momentum, Rise.ai powering post-purchase loyalty, and Prismfly optimizing every click for profit.

Let’s dive in before the chaos hits.

Retention is the battleground, and most brands are still playing defense.

A new Emarsys report shows that the strongest D2C brands heading into Q4 are shifting focus from acquisition to retention. Why? Because customer loyalty is now the real growth lever when ad costs spike and inboxes flood.

Here’s what’s changing:

Why it matters: BFCM will expose the gap between brands who’ve invested in retention and those who haven’t. With CPMs climbing and margins tightening, lifecycle marketing and reactivation flows could be your biggest profit driver this season.

💡 Operator Takeaway: Use October to shore up post-purchase and reactivation flows. Collect preference data now, not during BFCM. And don’t chase discounts, build moments that turn first-time buyers into repeat customers before 2026 hits.

What’s the vibe across the D2C ecosystem right now?

Every operator’s feeling it… CPMs creeping up, creative fatigue setting in, and inboxes that are about to be louder than Times Square.

That’s why this breakdown from Olly Hudson (shared straight from Meta’s Northern Summit) hit a nerve across the D2C world. Meta revealed the six biggest mistakes brands make in Q4, and it’s basically a blueprint for what not to do as we head into peak season.

What stands out isn’t just the tactics, it’s the mindset shift. The best operators aren’t waiting for Black Friday anymore. They’re launching earlier, optimizing for discovery, backing creators, and running through Q5 instead of going dark after Cyber Monday.

If Q4 is the Super Bowl of D2C, this is the playbook you study before kickoff.

Meta just revealed the 6 biggest mistakes DTC brands make in Q4.

If you're scaling into peak season, this is essential reading.

(straight from Meta’s Northern Summit)

1. Brands launch too late.

The highest spenders don’t wait for Black Friday.

They start before mid-November

— Olly Hudson (@oliverwhudson)

4:57 PM • Oct 14, 2025

💡 We’ll say it again: the winners this season are the ones who plan like it’s already mid-November.

We’re data nerds so you don’t have to be. Each week we’ll bring you some data to chew on with The Data Drop.

Holiday shoppers are skeptical but strategic.

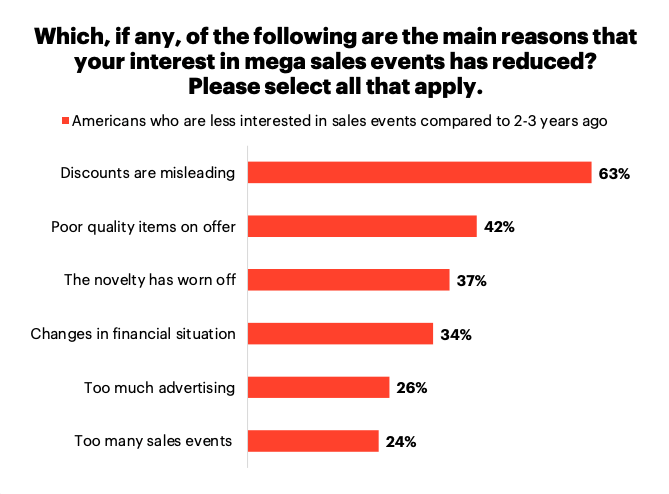

YouGov’s U.S. Mega Sales Report finds that while interest in Black Friday and Cyber Monday remains steady (39% and 38%), 36% of consumers say their excitement has dropped, mostly due to misleading discounts (63%) and poor product quality (42%).

Meanwhile, 22% plan to shop earlier this season to avoid tariff-driven price hikes, and 43% say they’re more likely to prioritize “Made in USA” products, signaling a shift toward value, trust, and transparency.

YouGov US Black Friday & Cyber Monday 2025 report

Generational trends:

Spending outlook:

Two-fifths of shoppers spent $250+ last year, but 25% plan to spend less in 2025. Still, 37% admit they’re holding off on essentials to buy during sales, showing deal-dependency is alive despite fatigue.

💡Operator Takeaway:

One tool, one brand, one agency to watch out for this week.

What they do: Rise.ai is the leading gift card and store credit solution built for Shopify brands. It helps D2C operators turn one-time shoppers into repeat buyers through branded gift cards, loyalty rewards, and store credit automation. With seamless Shopify integration, Rise.ai lets teams launch retention-driving programs in minutes, without complex loyalty builds or dev work.

Why it matters: Gift cards and store credit are massively underutilized revenue levers, especially heading into Q4. During BFCM, shoppers are already in a gifting mindset, and post-holiday credit redemption (Q5) can drive up to 20–30% incremental revenue. Rise.ai makes it easy for operators to own that moment: boosting AOV, retaining holiday buyers, and fueling repeat purchases into 2026.

💡Here’s what this means for you:

Prismfly is the go-to agency for brands that care less about louder ads and more about smarter growth. Known for turning underperforming funnels into high-converting machines, they blend CRO, design, and lifecycle strategy to unlock revenue from the traffic you already have.

💡 The takeaway for you: In a climate where growth via acquisition is getting harder, optimizing your funnel and retention stack is mission critical. Prismfly’s core strengths (site experiments, lifecycle flows, design that converts) align precisely with the shifts we’re seeing across D2C, like retention becoming the real battleground and “smart over loud” strategies winning out.

How they could take your brand to the next level

👉 Tighten your funnel. Run simple A/B tests or heatmaps to find drop-off points before Q4 traffic spikes.

👉 Push for integrated lifecycle + CRO thinking. When your agency thinks only about acquisition, they’re leaving margins on the table.

👉 Test fast, scale smart. Trial bundling or post-purchase upsells in small batches before rolling out wide.

What they are & what’s making noise: Graza is a D2C olive oil brand that turned a commodity into a cult favorite. Their packaging (squeeze bottles), bold design, and approachable premium positioning make high-quality olive oil feel fun, usable, and everyday. In a crowded, traditional space, Graza carved differentiation through design + usability + community-first growth.

Why they matter right now: They’ve pulled off multiple launches and product formats (refills, new SKUs) with minimal reliance on heavy ad spend; instead leaning on influencer seeding, social content, and brand storytelling. That’s validation that in categories with tightening margins, branding + community investment can carry heavy weight.

💡What we can steal / apply:

At 1-800-D2C, we spotlight the real builders behind the tools and brands featured on our site and the D2C players putting those tools to work. Let’s collab: