The era of D2C web commerce stores and the Shopify boom promised a new era of entrepreneurship. You could launch a brand from your laptop, scale to millions, and have a shot at becoming the next Warby Parker. Yet, behind the Instagram success stories, there lies a brutal reality: 70–85% of direct-to-consumer brands never see their third birthday — most don't even make it past the first year.

Haus, the direct-to-consumer aperitif brand that raised around $17 million, including a $4.5 million seed round, was forced to shut down in 2022 after its Series A fell through, leaving the company without runway. Allbirds’ stock tumbled from its IPO high of ~$28 to under $1 by spring 2024, which triggered a Nasdaq compliance warning, before recovering to around $11 following a 1-for-20 reverse split.

These aren't outliers. They're the norm. According to U.S. Small Business Administration (SBA) data, roughly 50% of new businesses close within five years, with approximately one-third shutting down by the end of their second year. Internal surveys from 1-800-D2C show similarly high early failure rates among digitally native brands.

The real culprits? Paid media CPMs have climbed 10–32% YoY since the iOS 14 privacy changes, depending on the platform and period. At the same time, consumer startup funding has fallen by more than 50% since 2022, with direct‑to‑consumer brands experiencing funding drops in the 90% range. But even with macroeconomic pressure, what really tips many under is the compounding effect of foundational missteps, like poor unit economics, over-reliance on paid acquisition, and lack of scale, making collapse all but inevitable.

[cta-btn title="Build Your Brand And Become A Member" link="/membership-pricing"]

The DTC graveyard is filled with the plaques of a plethora of promising brands that failed to make it out of the first year. Peloton's pandemic surge masked underlying unit economics that turned exponentially sour when growth slowed. Peloton's equipment sales plunged 27% year-over-year in Q3 2025, and total paid memberships dropped by 500,000 in just one year.

Brandless raised nearly $300 million before shutting down in early 2020, demonstrating that even massive VC backing can't save fundamentally unsustainable business models.

Meanwhile, Outdoor Voices cycled through leadership. Founder Tyler Haney exited amid the company “hemorrhaging” cash (approximately $2 million/month in losses) when Outdoor Voices after overspent on customer acquisition and struggling to maintain profitability.

Each collapse follows a predictable pattern: early traction from a small pool of enthusiasts, aggressive scaling fueled by outside capital or reinvested revenue, then a sudden wall where acquisition costs spike and retention completely. Of course, the timeline varies, but the destination remains constant somewhere between months 12 and 36, the D2C brand drops.

[single-inline-tool]

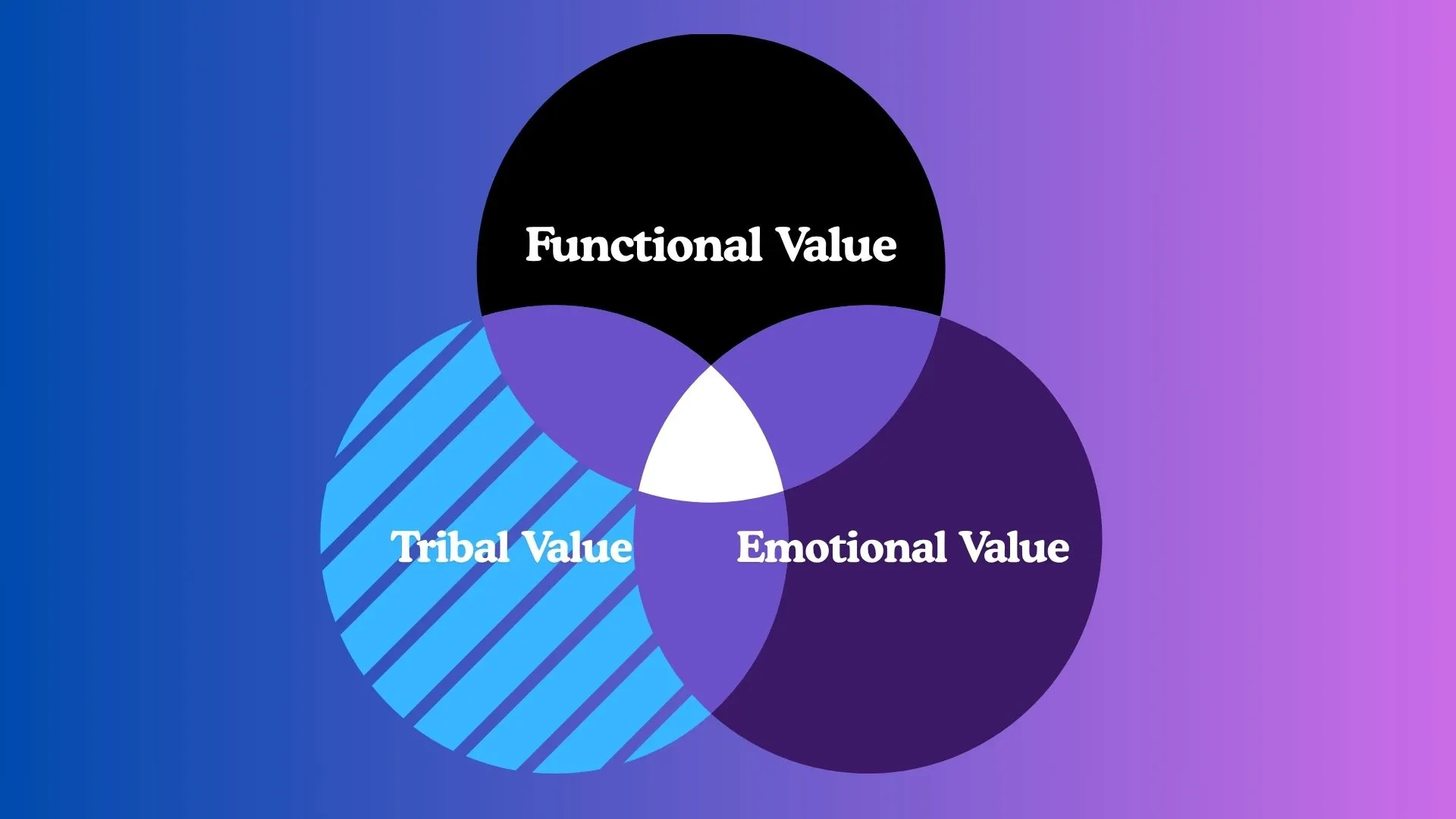

Founders confuse social media engagement for actual demand. A thousand likes on your product announcement doesn't translate to a thousand customers. The mistake compounds when brands launch with bloated catalogs instead of perfecting a hero product. Meanwhile, every additional product dilutes focus, complicates operations, and muddles the brands overall value proposition.

Here's a sobering discovery: half of many brands' media spend goes toward retargeting ads that simply remind existing buyers. These customers are people who would have converted anyway. Meanwhile, 80% of budgets flow to Meta ads and Google ads (SEM campaigns), where rising costs create a vicious cycle. D2C Brands pour money into the top of the funnel while ignoring the bucket's gaping holes. When your conversion rate multiplied by retention rate equals a negative contribution margin, no amount of traffic will save you.

Your in for a bad time if high-traffic product pages produce 50%+ exit rates. Or, if you're building checkout processes that require seventeen clicks for a final purchase. Even worse if you have value propositions buried below the fold. These aren't edge cases for brands, they're industry norms. Brands obsess over driving traffic while their virtual storefronts leak customers like a pipeline full of holes. The math is important for undoing the damage: doubling your conversion rate cuts your customer acquisition cost in half.

A low 60-day repurchase rate represents an early death sentence for self-funded brands. Yet, most DTC companies treat email as an afterthought, deploying generic welcome sequences copied from competitors. And then, their SMS flows remain unbuilt. Furthermore, post-purchase experiences feel transactional rather than relationship-building. When your business model depends on repeat purchases but your retention strategy consists of occasional sale announcements, failure becomes mathematical certainty.

Success intoxicates and muddies your ability to scale effectively. A good month leads to tripled inventory orders. A profitable campaign triggers six-figure monthly media budgets. But, scaling prematurely elongates cash conversion cycles, and subsequently amplifies every operational inefficiency. Brands burn through capital chasing growth without establishing contribution margin guardrails or understanding their true unit economics for their core product.

Freight costs can spike 40% overnight. Your payment terms shift from net-30 to COD. Then, due to returns management issues, your returns pile up in warehouses, tying up capital and eroding margins. These operational realities destroy more brands than competition ever could. Without multi-month cash forecasting or real-time contribution margin reporting, founders fly blind until the bank account hits zero.

Over 100,000 DTC stores compete for attention in the U.S. alone. Every Google algorithm update levels the playing field. Overseas manufacturers can knock off your hero product and undercut your price within weeks. Without genuine differentiation, like a loyal community, compelling brand story, and exceptional customer experience, you're just another logo in an endless scroll of D2C options.

You absolutely need product-market fit. Validation beats assumption every time. Run pre-order tests. Build waitlists. Mine Reddit threads and Facebook groups for unfiltered feedback. Focus relentlessly on a hero product until it represents a majority of new-customer sales. Remember, complexity kills more brands than competition.

Stop chasing traffic and start converting visitors. Run systematic CRO sprints: heat-maps reveal problems, hypotheses guide solutions, A/B tests validate improvements. Implement the three-click rule to purchase. Display at least five types of social proof. Tools like Optimizely and VWO turn guesswork into science.

The temptation to be everywhere kills focus and dilutes your ability to thrive in a niche D2C e-commerce market. Instead, dominate a single channel using a 90-day test template: creative velocity, offer testing, payback modeling. Only layer TikTok, influencers, or affiliates once your primary channel achieves sub-three-month payback. Depth beats breadth in customer acquisition.

Retention and retention tools aren't a phase-two priority, these items are foundational. Deploy the core flows immediately: welcome series, abandoned cart, post-purchase, replenishment reminders. Layer in loyalty mechanics through discount ladders and VIP tiers. Every percentage point improvement in retention compounds over time.

Financial discipline separates D2C brand survivors from statistics. Maintain a rolling 13-week cash forecast. Target inventory turns of 4x+ annually. Establish a gross margin floor of 60% and defend it religiously. When cash gets tight, cut experiments, not fundamentals.

Price wars end in mutual destruction. Build moats through owned communities on Discord or Slack. Then, develop ambassador programs that turn customers into evangelists for your unique product offering. Invest in post-purchase experiences: thoughtful subscription gift boxes, surprise upgrades, concierge-level support. These intangibles create switching costs that algorithms can't replicate.

Print this. Review monthly. Brutal honesty required:

Three or more "yes" answers signal danger. Five or more? You're already on borrowed time.

Despite the failures of many D2C brands, e-commerce is still a thriving and lucrative online vertical. Consumer appetite for innovative brands continues steady growth. The difference between thriving and dying comes down to discipline, customer obsession, and partnering with the right tools and D2C agencies.

The brands that survive year three share common traits: they solve real problems for specific audiences, they measure what matters, and they build sustainable operations before chasing scale. They understand that in the DTC game, concrete fundamentals beat growth hacks every time.

The graveyard is full of brands that confused early traction for product-market fit, that scaled on quicksand foundations, that believed their own hype. Don't join them. Build something worth keeping alive and scale your D2C e-commerce empire.

[inline-cta title="Discover More With Our Resources" link="/resources"]

Brandwise shows all of your brand's comments and messages in one place. Our AI helps you moderate negative comments in real-time and automatically generate accurate replies - saving your team time and boosting your ROAS.